DISCLAIMER: This article does not constitute advice to buy or sell any specific security. You should do your own research and exercise caution when dealing in securities.

AEM Holdings Ltd. (SGX: AWX) is a semiconductor and electronics test solutions provider. I have been buying AEM shares recently and intend to exploit the recent sell-off to buy even more. In this article, I will tell you what I know about the business and why I like it as an investment.

Company background

Over the past decade, AEM has undergone quite a significant transformation. When it was previously known as AEM-Evertech, its former CEO and managing director, Ang Seng Thor, was investigated and charged for corruption and immigration offences between 2000 and 2005 (see this CPIB press release).

In September 2011, Novus Tellus Capital Partners, a private investment firm, bought a 16.6% stake in AEM for $0.06 cents per share (it subsequently upped its stake to 25%). Loke Wai San, managing director of Novus Tellus, became chairperson of AEM and set a new direction for the company.

Read a 2014 The Edge article about AEM here.

AEM exited the SGX watch-list on 12 April 2012, and over the past decade, focused on investing in research and development in its main Equipment Systems Solutions (ESS) segment. What is ESS? This is AEM’s description, extracted from its annual reports:

Providing customised system solutions involving precise high speed motion and innovative mechanical design to both mass volume manufacturers and new technology development laboratories.

Explanation of the ESS segment in AEM annual reports

Not quite sure what exactly they do in the ESS segment? Same here. Reading various articles, I have come to understand the following (in laypeople’s terms):

- Integrated circuits are the basic unit of all electronic devices. They are found in computers, smartphones, cars, medical equipment, etc.

- The manufacturing of modern integrated circuits is extremely challenging. For example, the factories must be almost dust-free.

- Even with the most advanced factories and manufacturing equipment, not all integrated circuits turn out well. A small percentage of them do not work as intended.

- Automated testing equipment tests integrated circuits to determine which ones are not fit for use.

Of course, I could be very wrong. I have no expertise in electrical engineering. But the above explanation kind of makes sense to me.

AEM has been working to develop such testing equipment for Intel over the past decade or so, and this has clearly paid off, based on recent financial results.

You can read more about AEM’s transformation in a 2017 Business Times article here. Since 2017, the company has achieved even greater heights.

What I like about AEM

Skilled and talented management

AEM’s chairperson Loke Wai San is clearly something of a genius. Under his guidance, AEM’s share price rose from less than $0.10 before coming onboard in 2011 to $3.47 today. As long as he continues to lead AEM’s board, I think there are still many opportunities for growth.

AEM also has CEOs who are skilled and experienced. Charles Cher (April 2014 to April 2018), Chok Yean Hung (April 2018 to June 2020) and Chandran Nair (since July 2020) are all industry veterans with valuable experience leading companies in operating in various aspect of electronics manufacturing.

High profit margins

It is not much of a challenge for any company to leverage up and boost revenue. What is not so common is for a company to have pricing power (in our earlier article about intrinsic value, I explained why it is important for companies to have an economic moat). I took a look at AEM’s financials and was quite impressed with the recent results.

| 2017 | 2018 | 2019 | 2020 | |

| Margin | 22.52% | 13.00% | 20.97% | 16.63% |

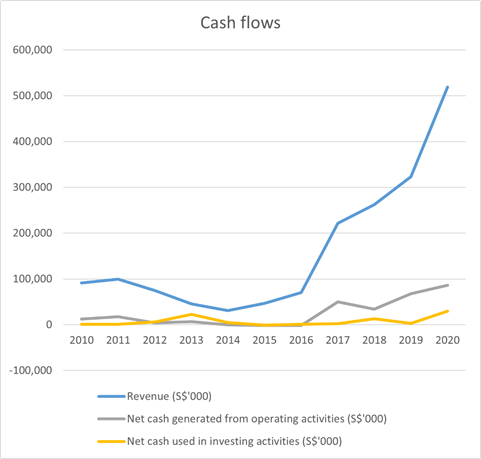

For the table above, I calculated margin as ‘net cash generated from operating activities’ over ‘revenue’ (there are various, more common, definitions of margin such as net margin, gross margin, etc.). Clearly, AEM’s margin has been stable, over 10%, in recent years.

Being able to maintain high margins is indicative of certain characteristics of the business model that allow the company to maintain high prices. This gives us confidence that AEM will continue to be profitable in the years to come.

Sunrise industry

Chips are all the rage at the moment, and we are in a massive global chip shortage. The Covid-19 pandemic led to lower supply as companies reduced their orders on uncertainty and higher demand as consumers bought more IT equipment. Advances in cars are also taking up an increasing chunk of chip supply (entertainment systems, parking assist, cruise control, etc. are all systems that require computer chips in your car).

The EU wants to double its chipmaking capacity by 2030, occupying 20% of the global market. Meanwhile U.S. President Joe Biden is pushing to secure $50 billion in government funding to revitalize the U.S.’s domestic industry.

Source: Fortune article

I think that this surge in the building of fabrication facilities will benefit AEM as more testing equipment will have to be installed.

Numbers

Let us take a look at AEM’s numbers.

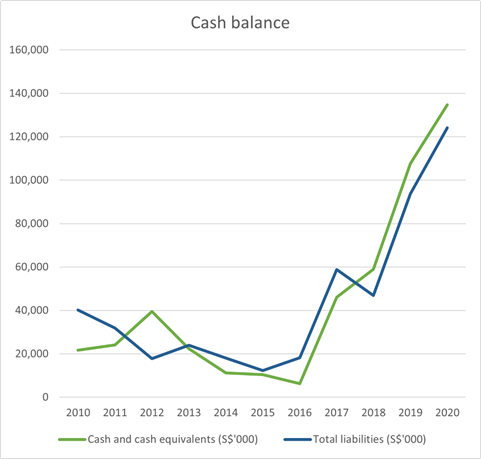

AEM has boosted its cash balances in recent years, and has been net cash for the past few years. This has allowed it to acquire stakes in other companies without much need to raise funds.

Cash flows also look solid, with revenue increasing from 2014. Since 2017, net cash generated from operating activities have also been quite significant, resulting in the ballooning cash pile.

What about the latest business update?

On 4th May 2021, the share price dropped by about 6% from the previous days close, ostensibly in response to a business update that AEM released. The share price has slid even more since then, probably due to the global tech selloff (see, for example, this Bloomberg article).

But why did investors sell AEM shares after the Q1 results were released? We summarise some key points from the release here:

- Revenue fell by 45% to S$80,230,000 in 1Q2021 compared to S$146,826,000 in 1Q2020.

- Net profit after non-controlling interests fell by 63% to S$13,203,000 in 1Q2021 compared to S$36,134,000 in 1Q2020.

- FY2021 revenue is guided to be between S$460 million to S$520 million, with heavier weighting in 2H2021.

You can read the full set of results here.

Just looking at the numbers alone, the plunges in revenue and net profit are drastic indeed. However, upon deeper analysis, I do not think this is too much of a concern.

Take a look at AEM’s quarterly revenues and profit before tax (PBT) from 1Q2019 to 1Q2021. You should notice that they vary quite a lot from quarter to quarter without a smooth trend. This is most likely because their business model (selling very expensive pieces of equipment to manufacturers) is lumpy in the sense that their customers do not necessarily spend evenly across the 4 quarters. In fact, 1Q2021’s results are not much worse than 4Q2020 (comparing quarters year-on-year makes sense for some businesses such as consumer retail or F&B, but not so much for AEM).

In the same results release, what caught my eye was the revenue guidance of between S$460 million to S$520 million for FY2021. (A ‘guidance’ in this context is simply an estimate or prediction by a company’s management.) Now, why should we trust what they say? A fact that should lend credence to their guidance is AEM has so far beat the revenue guidance provided at the end of the first quarter for the past 3 years.

| 2018 | 2019 | 2020 | 2021 | |

| Revenue guidance at the end of Q1 | “At least S$255 million” | “S$225 million to S$250 million” | “S$360 million to S$380 million” | “S$460 million to S$520 million” |

| Actual full-year revenue | S$262 million | S$323 million | S$519 million | ??? |

If the past few years are anything to go by, we have nothing to worry about FY2021 revenue.

Counterpoint

So far, AEM almost appears faultless. Here comes the bombshell.

95.11% of FY2020 revenue came from AEM’s main customer, which is widely believed to be Intel Corporation. This trend has been getting more extreme over the years (in FY 2015, this customer made up only 81.89% of revenue).

Clearly, this presents a huge risk to AEM. If Intel’s management decided to get testing equipment from other companies instead, AEM would be decimated. However, I am willing to put up with this risk for two reasons.

First, the long duration of the relationship between AEM and Intel implies deep knowledge of Intel’s requirements, as the equipment that AEM has been designing and producing has essentially evolved alongside Intel’s product streams. This might make it difficult for any other company to understand Intel’s testing requirements to the depth required. If you have been going to the same family GP for 10 years, who will you go to when you develop a strange flu?

Second, AEM management has been acutely aware of this risk and has been actively acquiring stakes in related businesses using internal resources as well as issuing new shares. This avails more business opportunities for AEM to exploit, possibly leading to diversification away from Intel in the near future.

Business valuation

It is difficult to value companies based on growth prospects as the uncertainty in future revenues and profits are quite significant and any minor tweaks in assumptions will result in big deviations.

I would assign a conservative valuation of $4.60 per share. While this has been risk-adjusted to some extent, I am unable to fully price in the risk involved in cyclical industries such as the semiconductor industry. One investing in AEM shares must be cognisant of the non-zero risk of a very negative outcome. This is also under the assumption that Intel sticks with AEM.

While the margin of safety is not large in this case (especially vis-à-vis my first purchase of AEM shares), I do believe that AEM is a wonderful company at a fair price. Therefore, I am willing to take on a little bit of risk for the chance of outsize gains. That said, I will never purchase shares at a price above my estimate of intrinsic value.

My trades

These are all the trades that I have done in shares of AEM (SGX: AWX), as of 4th May 2021:

- 13 April 2021: BUY at $4.03

- 4 May 2021: BUY at $3.80

As of 12 May 2021, AEM shares are priced at $3.47. I do intend to make more purchases of AEM shares soon.

Don’t want to miss out on any articles? SUBSCRIBE with your email address here: