People our age have too much on our hands. Studies, job-hunting, navigating office politics, relationships, the list goes on. So much so that we tend to ignore mundane and seemingly less urgent issues such as saving for retirement. In our previous article, we put forward an argument why the best time to start saving is now. But what should you do with the money set aside? In this article, we will explain why we think you should invest your savings rather than letting it languish in some dark corner of a bank account.

What does it mean to invest?

Some people have the mistaken idea that to invest your savings is to be on your computer/phone all the time monitoring financial markets around the world. Nothing could be further from the truth. If anything, I would not consider such frequent trading ‘investing’.

“An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return.

Ben Graham and David L Dodd (1934), in Security Analysis

Rather, investing in the stock market with a buy-and-hold philosophy can be done efficiently through index funds, which buy and hold shares in the biggest companies of that economy. Such an approach does not require you to do any research on any business or to engage in investment transactions more than once a month. In fact, there are ways for you to automate that using Regular Savings Plans, so you do not even have to manually transact your investment. I will come back to this later.

An illustration

Just like in the previous article on saving early, we will provide an illustration to demonstrate the difference that investing your savings can make.

Suppose that two squirrels (current age 25) want to accumulate S$1 million in savings by age 63 (which will be the new retirement age in Singapore in 2022). Both squirrels are willing to set aside a fixed, constant sum of money as savings every year towards this goal.

Let us compare two different ways to put the savings to use. The safe squirrel keeps its savings in bank accounts and fixed deposits. At the moment, local bank accounts generally yield less than 1% of interest per annum (source here), as do local fixed deposits (source here). However, we do not deny that interest rates will probably rise at some point in the near future. For this illustration, we will estimate the long-run average interest rate on bank accounts and fixed deposits generously at 2%.

On the other hand, the stocks squirrel passively invests in the S&P 500 Index. This is a stock index measuring the performance of 500 of the biggest companies in the US. Stock squirrel does this by buying shares in an S&P 500 index fund, which then buys shares in the 500 companies constituting the index. Stock squirrel blindly buys the shares on the first day of each year using the sum set aside for that year.

How much can we expect this strategy to return? Investopedia claims that the S&P 500 Index returned an average of 10% to 11% annually from 1926 to 2018, and about 8% from 1957 to 2018 (source here). On the other hand, the Business Insider estimates the average annual return of the S&P 500 to be 13.6% over the past 10 years (source here). Note that these figures are not total return figures, so they have not even taken dividends into account. The SPDR S&P 500 ETF Trust, the world’s largest ETF and main S&P 500 tracker fund, has returned 10.36% annually since its inception on Jan 22 1993, according to its website. For this illustration, we will estimate the long-run average return on our chosen index (S&P 500 Index) conservatively at 8%.

How much will each squirrel have to put aside each year? We did some simple calculations in Excel.

| Safe squirrel | Stocks squirrel | |

| Initial age | 25 | 25 |

| Annual return | 2% | 8% |

| Retirement age | 63 | 63 |

| Yearly saving required | $16,834.46 | $3,875.13 |

| Monthly saving required | $1,402.87 | $322.93 |

The safe squirrel will have to put in $16,834.46 a year, which translates to setting aside $1,402.87 a month. A hefty chunk of salary indeed.

The stocks squirrel, on the other hand, will only have to put in $3,875.13 a year, which translates to setting aside $322.93 a month. Much more palatable.

We see that despite both setting aside a fixed sum yearly from age 25 to 63, the safe squirrel has to put in more than 4 times as much each year compared to the stocks squirrel.

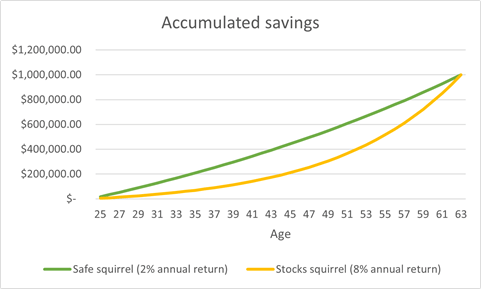

We can plot the data on a chart to see how the savings accumulate.

We can see that the slope for the safe squirrel is much gentler, telling us that its accumulated savings are growing rather linearly (linear means straight line). This is because most of the growth is coming from the annual contribution, which is the same fixed amount every year.

On the other hand, the slope for the stocks squirrel starts off gentler, then gets much steeper quite quickly. This exponential shape is due to the compounding effect that a higher return (8% on the S&P 500 Index) proffers. The stocks squirrel puts in much less money each year (less than a quarter of what the safe squirrel puts in), but lets the compounding work its magic to hit the same goal.

How you can invest

If this article has managed to convince you of the importance of investing your savings, you may now be thinking about how to invest. As alluded to above, index funds are a wonderful vehicle for long-term investments. Put simply, buying a share in an index fund is indirectly investing in the biggest companies of that country. Multiple studies done have shown that index funds tend to perform just as well, if not better, than the average of professional fund managers (see, for example, here). Take a look at our earlier article explaining what index funds are.

You can invest in index funds either manually or by using a Regular Savings Plan (RSP). RSPs, such as the ones offered by DBS/POSB and OCBC (I have good experiences with both), automatically deduct a pre-set amount from your bank account each month to buy shares in your chosen index fund. The fees are reasonably low and they are a brilliant way to invest your regular savings without having to lift a finger. We previously posted an article about RSPs here.

Squirrel says…

- Do you really need to invest? No, but you really should.

- Consider putting your savings in an index fund. Regular savings plans are a very convenient way to do this.