Centurion Corporation Limited (SGX: OU8) is a company I first invested in about a year ago. Since then, the share price has dropped further, and I am currently looking to increase my position.

| Name and SGX ticker symbol | Centurion Corporation Limited (SGX: OU8) |

| Main business segments | Worker and student accommodation |

| Market capitalisation (as of 12 June 2021) | S$282 million |

| Share price (as of 12 June 2021) | $0.335 |

| Estimated intrinsic value per share | $0.50 |

DISCLAIMER: This article does not constitute advice to buy or sell any specific security. You should do your own research and exercise caution when dealing in securities.

Company background

Centurion owns, develops, and manages purpose-built workers accommodation and student accommodation assets around the world.

Centurion was previously an optical disc manufacturer known as SM Summit Holdings Limited. In 2011, Centurion entered the purpose-built workers accommodation (PBWA) business following a reverse takeover (RTO). The RTO was led by two cousins, David Loh and Han Seng Juan, who are both high-flying former investment bankers at UOB. They currently own more than half of Centurion through their holding company, Centurion Global Ltd. In 2014, Centurion entered the purpose-built student accommodation business (PBSA).

Today, Centurion manages 35 properties in 6 countries, namely PBWA buildings in Singapore and Malaysia under the ‘Westlite’ brand; and PBSA buildings in Singapore, Australia, South Korea, United Kingdom, and United States under the ‘dwell’ brand. As of 1Q2021, 74% of revenue came from PBWA and 25% from PBSA. (If ‘Westlite’ sounds familiar to you, it is probably because Westlite Woodlands dormitory was a major Covid-19 Cluster.)

Management

David Loh and Han Seng Juan joined the board in May 2015 and became joint chairpersons in November 2019. I have no doubt that they know how to make money. Owning more than half of Centurion together, they have a strong interest to help Centurion do well. Considering that capital structure is key for a leveraged property business like Centurion, it is good that Centurion is led by two former investment bankers.

The independent directors include the typical vocational line-up – a lawyer (Chandra Mohan, partner at Rajah and Tann Singapore LLP), an accountant (Owi Kek Hean, former deputy managing partner at KPMG LLP), a civil servant (Tan Poh Hong, former AVA CEO), and an investment banker (Lee Wei Woon, former executive director at Morgan Stanley Asia).

Current CEO Kong Chee Min, who took up the role in August 2011, is a trained accountant and joined Centurion in March 1996, way before the group went into PBWA and PBSA.

During the Covid-19 pandemic, the then-minister of manpower Josephine Teo visited Westlite Papan dormitory (see here), adding credibility to the company as a major player in this sector.

For more information, you can read this Business Times article about Kong Chee Min and Centurion.

Numbers

For companies who hold lot of tangible assets at fair value, net profit is not a good measure of the business’ performance as fair value may fluctuate from year to year. Suppose you are analysing a hotel business. In one year, there are protests in the vicinity of the hotel so the valuation of the land and building fall drastically. This is captured as a loss in the financial statements, resulting in exceptionally low or even negative net profit. The following year, the government may announce the building of an MRT station near the hotel, resulting in the land value increasing significantly. This is then reflected as profit in the financial statements. The business performance (in terms of number of room bookings and price point) may have been similar, but the net profit would have varied wildly from year to year.

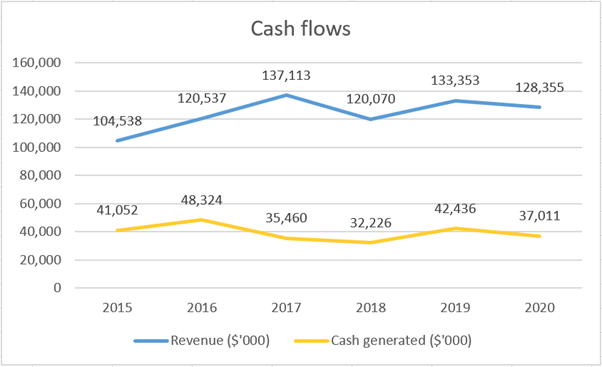

What I will look at, instead of net profit, is net cash provided by operating activities less interest paid (‘cash generated’).

While the cash generated has largely remained stagnant, they do show reasonable consistency and resilience. Coupled with generous dividend payouts (at least $0.02 for each of FY2016-2019) backed by cash flow, Centurion appears to be a decent cash cow. Centurion also retains a decent chunk of earnings which it can then use to reinvest and expand market share.

Net gearing (total liabilities over total assets) has been quite steady (and in fact, on a slight downtrend) between 58% and 65% over the past six years.

Industry dynamics

The accommodation sector around the world has been hit hard by the Covid-19 pandemic. Student accommodation, in particular, suffered heavily as universities moved to distance-learning. However, I feel that the long-term value proposition of the PBWA and PBSA businesses still hold.

In September 2020, Centurion secured a contract to lease and manage four Quick Build Dormitories (QBDs), further increasing Centurion’s capacity and cementing market share.

The Covid-19 pandemic will likely lead to PBWA requirements in Singapore and Malaysia evolving. In August 2020, the Malaysian Human Resources Ministry announced stricter rules for foreign worker dormitories that include more space per worker and providing basic items. Stricter guidelines may improve the margins for the PBWA business.

Having had to find student accommodation in London not to long ago, I have no doubt that student accommodation assets in the UK will hold their value and continue to enjoy strong demand. While there is still no certainty that all universities will return to face-to-face teaching in the 2021/22 academic year, many have indicated a blended approach involving online lectures and in-person tutorial classes.

Intrinsic value

A very conservative estimate of intrinsic value (assuming very little growth) would be $0.50, which proffers a large margin of safety. However, one needs to be aware of the liquidity risk present in leveraged companies, especially if the US Federal Reserve raises interest rates. This is because loans still have to be repaid at fixed dates regardless how much revenue the company brings in.

My trades

My trades in OU8 so far are:

- 13 June 2020: BUY at $0.36.

- 8 March 2021: BUY at $0.335.

I am looking to add to my current position in OU8 soon.

Don’t want to miss out on any articles? SUBSCRIBE with your email address here: