I first invested in China Sunsine at the start of 2020, just before the pandemic-induced stock market crashes came. I was drawn to the ridiculously large net cash position as well as steady growth in output capacity over the past decade. The relatively large (for Singapore standards) market capitalisation of over S$500 million is also quite a draw. Other companies that I have been investing in have much smaller market capitalisations (e.g. Koda) which may result in a bit more risk.

| Name and SGX ticker symbol | China Sunsine Chemical Holdings Ltd. (SGX: QES) |

| Main business segment | Rubber chemicals for tire companies |

| Market capitalisation (as of 9 August 2021) | S$505 million |

| Share price (as of 9 August 2021) | S$0.520 |

| Estimated intrinsic value per share | S$0.75 |

DISCLAIMER: This article does not constitute advice to buy or sell any specific security. You should do your own research and exercise caution when dealing in securities.

Company background

China Sunsine Chemical Holdings Ltd. (SGX: QES) produces specialty chemicals used in rubber processing. It produces rubber accelerators, insoluble sulphur, and anti-oxidant in its production facilities in the Shandong Province of China. These chemicals are used in the vulcanisation process that converts natural/synthetic rubber (soft and sticky) into cured rubber (durable) that can be used to make tyres for vehicles. China Sunsine is the largest producer of rubber accelerators in the world and has over 1,000 customers including more than two-thirds of the Global Top 75 tyre markers, such as Bridgestone, Michelin, Goodyear, Pirelli, Sumitomo, and Yokohama.

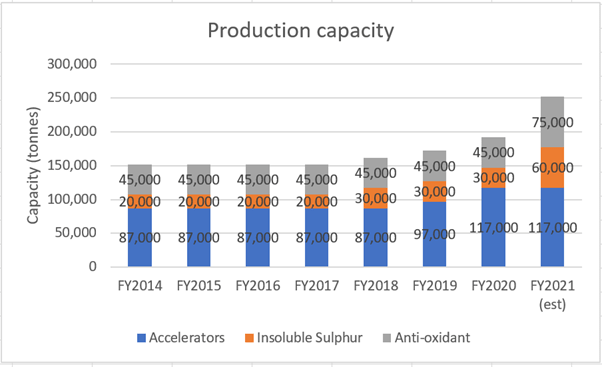

China Sunsine has been increasing sales volume (in terms of tonnes of chemicals) year after year for the past decade, as shown in Figure 1 below.

In recent years, China Sunsine has taken steps to increase capacity by investing in more production facilities. In particular, insoluble sulphur and anti-oxidant capacity will almost double by the end of the current year (as shown in Figure 2 below).

This is timely because as of FY2020, the utilisation rate for accelerators, insoluble sulphur, and anti-oxidant was 78%, 102%, and 102% respectively (source here) . It is therefore likely that the additional capacity will be soaked up when the expansions come online, resulting in a boost to revenue and profit.

However, despite the consistent increase in sales volume, revenue has not always increased year-on-year. This is due to fluctuations in the average selling price (N.B. revenue is equal to sales volume multiplied by average selling price). The average selling price is determined by two factors beyond the firm’s control – the oil price and market competition. The chemicals that China Sunsine produces are derivatives of oil, so the higher the oil price, the higher the market price of the output chemicals. As the oil price has seen drops in the past few years, the price of the output chemicals has correspondingly fallen, resulting in lower revenue for China Sunsine despite higher sales volume.

The numbers

Revenue and profit

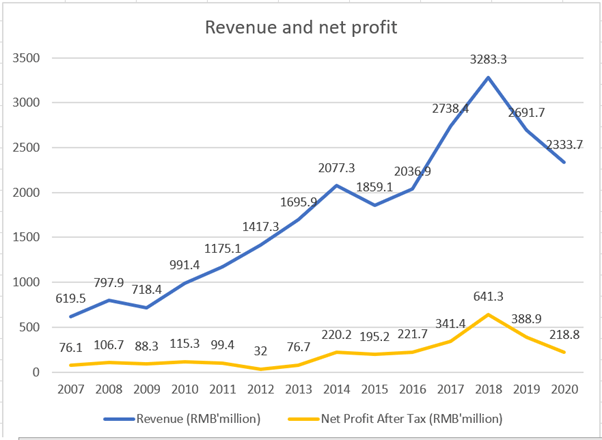

Figure 3 below shows China Sunsine’s revenue and net profit from FY2007 to FY2020. A clear upwards trend in revenue can be observed, whereas profit growth is not very steady.

Over this period, gross margin averaged 26% while net margin averaged 11%.

To get a clearer view of the profitability of the firm, we can look at the trailing 3-year average net profit (e.g. for FY2020, this value is just the average of the net profit in FY 2018, FY2019, and FY 2020). Figure 4 below shows this. The upward trend in profit-generation is now much clearer.

Balance sheet

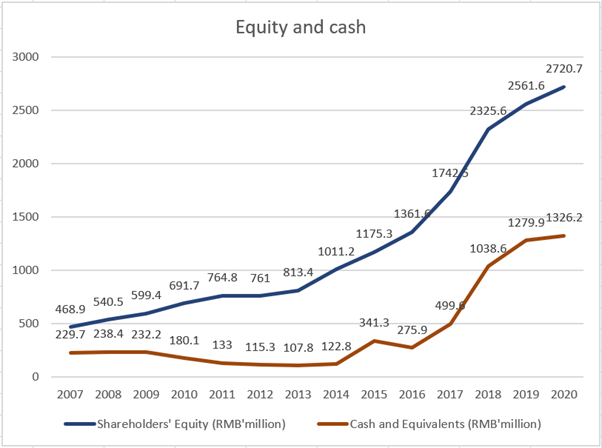

China Sunsine has a strong net cash position making up more than one-third of market capitalisation. What this means is that when you buy a share of QES at the current trading price, you immediately come to own a third of what you paid worth of cash, so you have really only spent two-thirds of the share price paying for your share of the underlying business.

Figure 5 below shows the shareholders’ equity and cash of China Sunsine from 2007 to 2020.

A growing shareholders’ equity arising from strong cash flow every year tends to be a promise that the share price will rise over time.

Latest scoop

China Sunsine recently engaged in share buybacks. Companies usually engage in Share Buybacks when they have excess cash and senior management adjudges the market price of shares to be lower than intrinsic value. You can read more about share buybacks in this post about how companies reward shareholders. Between 11 June 2021 and 7 July 2021, China Sunsine bought back a total of 325,000 shares between $0.510 and $0.520 each. This tells us that management feels that shares are worth significantly more than this price. (N.B. the actual quantum of shares repurchased is rather minute.)

On 30 July 2021, China Sunsine released a profit guidance statement informing shareholders that net profit for the first half of the year (that is, the six months ending on 30 June 2021) is substantially higher than the corresponding period last year. This is due to an increase in both average selling price as well as sales volume. The full results for 1H2021 will be released after trading hours on 13 August 2021.

The latest outbreak of Covid-19 in China may lead to lockdowns affecting industrial activity (China Sunsine exports only one-third of output – the remaining two-thirds and sold within China), but economic activity will most probably normalise at some point.

Intrinsic value

The revenue and profit levels of China Sunsine are rather dependent on the price of oil which is cyclical and difficult to predict. A conservative valuation, considering the cash-generative nature of the business as well as strong (almost excessive) net cash position, would give a lower bound on the intrinsic value of each share at S$0.750. At the last traded price of S$0.520, this is a 44% upside.

My trades

My trades in QES so far are:

- 14 Jan 2020: BUY at $0.54

- 20 Feb 2020: BUY at $0.455

- 15 Apr 2020: BUY at $0.34

- 2 Aug 2021: BUY at $0.53

I am happy to hold QES in the long-term (it is currently my biggest position, slightly ahead of AEM aka AWX).

Don’t want to miss out on any articles? SUBSCRIBE with your email address here: