I have not put up new posts for some time now largely because I have struggled to find anything interesting to write about. I have not chanced upon any SGX-listed companies trading at compelling valuations recently. This has been reflected in my trading activity – in the past three months, I have only made two relatively minor transactions, which are to sell my holdings in APAC Realty (SGX: CLN) in July and to buy even more shares in China Sunsine (SGX: QES) in August, which I recently wrote about here. I decided to sell the APAC Realty shares, which I bought about three years ago, due to a good market price and the possibility of impending property market cooling measures.

The lack of attractive investment opportunities on the local stock exchange has driven me to examine the REIT market for possible good buys. This article will explain all you need to know about investing in REITs, as well as put forth a few suggestions.

What are REITs?

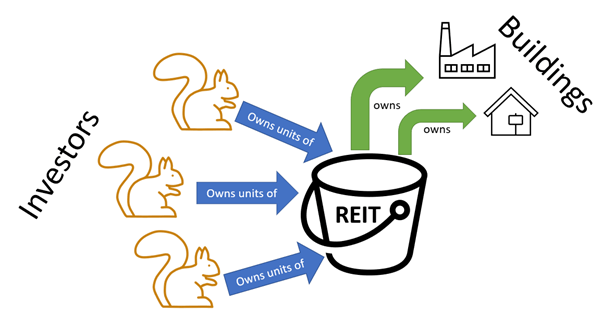

Real estate investment trusts, or REITs, are corporate entities that allow you to indirectly invest in real estate (buildings and land). Think of it like a bucket of money that investors pool together. The money in this bucket is then used to buy properties, which are then indirectly owned by the investors who contributed the money.

You can think of buying REIT units as ownership of a tiny fraction of a basket of properties. The buildings owned by the REIT are then rented out to tenants (for example, fast-food and clothing chains rent shop units in shopping malls), with the rent collected then distributed to the REIT unitholders as dividends.

REITs are tax-exempt under IRAS’ rules provided that they distribute at least 90% of income to unitholders. This is one of the main reasons why local investors love investing in REITs.

Although REITs are a big part of the local stock market today, this has not always been so. The first ever REIT listing in Singapore, that of SingMall Property Trust in November 2001 by Capitaland, was undersubscribed and subsequently scrapped. The first successful listing of a REIT was that of CapitaMall Trust in July 2002.

The local REIT scene has grown by leaps and bounds since then. As of September 2021, there are 42 REITs (and property trusts) listed on SGX, with a total market capitalisation of S$111B (about 12% of Singapore’s overall listed stocks). The average dividend yield of these REITs is 5.9% (source: SGX Research).

The significance of REITs is even more pronounced on the Straits Times Index, where REITs make up 7 out of the 30 constituents, and 14.8% of the index.

Structure of REITs

Beyond knowing that REITs pool investors’ money to buy property which is then rented out, there are a few parties with specific roles that you familiarise yourself with.

REIT manager

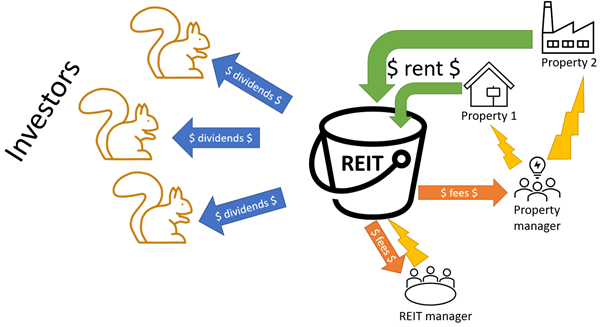

The REIT manager makes decisions for the REIT, such as buying new buildings, selling existing buildings, or financial decisions such as borrowing from banks or issuing new units. In return, REIT managers take a cut from the property income before distributing to unitholders.

Property manager

The property manager(s) manages the day-to-day matters of the properties owned by the REIT, including finding tenants, collecting rent, and maintaining the buildings. A REIT may have a single property manager for all its properties, or different property managers for different properties. Property managers take a cut from the property income before distributing to unitholders.

Sponsor

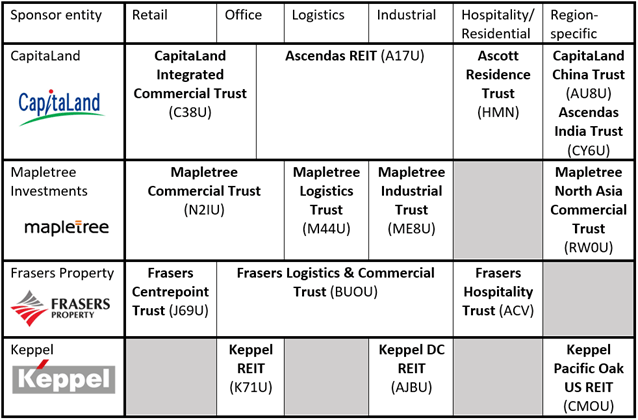

In addition to the REIT manager and property manager(s), some REITs have sponsors, which are usually large real estate companies. The four main REIT sponsors in Singapore are CapitaLand, Mapletree Investments, Frasers Property, and Keppel. Between them, they sponsor 15 locally-listed REITS.

The sponsor provides credibility and reputational backing to the REIT. For example, by riding on the sponsor’s credibility and connections, a REIT may have an easier time getting loans from banks. The sponsor usually owns the REIT manager and the property manager. Furthermore, as the sponsors are also engaged in real estate development, REITs have easy access to acquisition deals, by buying properties that their sponsor has developed.

Trustee

The trustee provides administrative services including holding legal ownership of the properties on behalf of the unitholders. In return, trustees get a small fee. Most major REITs utilise trustee services from major banks such as DBS or HSBC.

Figure 3 above shows how REIT managers and property managers come into the picture. They manage the REIT and the properties respectively (lightning symbols), in return for fees paid out from the REIT’s property income before it is distributed to investors as dividends. The Edge Singapore recently compiled an extensive list of fees for all the SGX-listed REITs, which you can view here.

Leverage in REITs

As alluded to above, REITs do not merely buy properties with unitholders’ money. They also borrow money so as to buy more expensive properties, which is called leverage. First, let us understand how leverage is measured.

A REIT’s debt ratio is defined as the ratio of total debt to total assets. For example, if I buy an apartment that costs $1m with a down payment of $250,000 and mortgage of $750,000, my debt ratio for this apartment is 75%. In Singapore, REITs are allowed to have debt ratios of up to 50%, under current MAS rules.

We can now move on to a simple example illustrating why REITs employ the use of leverage and how it is beneficial for unitholders. In this example, we will consider a REIT with $100m equity (recall that equity means ownership of something). You can think of it as a new REIT in which investors have put in $100m in cash. We will assume a capitalisation rate (that is, net property income over the value of the property) of 5% and an interest rate on bank borrowings of 2%. We will ignore fees (to REIT and property managers) for this example.

As illustrated in Figure 4 above, the REIT can either buy a property worth $100m, or borrow $50m from a bank and buy a property worth $150 million. In the former scenario, the REIT collects $5m a year in rent (5% of $100m), which is all distributed to unitholders as dividends. In the latter scenario, the more valuable property yields a higher rent of $7.5m a year (5% of $150m), but the REIT must pay interest on the loan to the bank of $1m (2% of $50m). This leaves $6.5m to be distributed to unitholders as dividends, almost a third higher than in the former scenario.

Do note, however, that leverage only profitable when capitalisation rate exceeds interest rate, because the profit gleaned from leverage is the additional rent collected minus the interest incurred. This has almost always been the case in the past decade of ultra-low interest rates following the Great Financial Crisis of 2008.

So then, is more leverage (that is, a higher debt ratio) always better? Theoretically, as long as the capitalisation rate is higher than the interest rate on borrowing, more leverage will be profitable. If you could borrow money at 2% to buy an additional building that rents at 5%, you can just sit back and collect 3% of the value of the building every year, without coughing up any initial capital of your own. The difficult part is if there are disruptions to the rental operation. The Covid-19 pandemic has resulted in cash flow issues for many highly-leveraged firms around the world, necessitating dilutive rights issuances that are prejudicial to long-term investors. Suppose that you borrow money at 2% to buy a hotel building that, on average during normal times, yields 5% worth of net property income. During the pandemic, hotel bookings fall drastically and net property income falls to 1%. You then have to cough up 1% of the value of the hotel building every year to continue to service the mortgage, otherwise the bank may foreclose on the hotel building. In the worst case, bankruptcy proceedings may be brought against the REIT resulting in little or no return for investors. REITs listed in Singapore are relatively conservative, with a hard debt ratio limit of 50% under the latest MAS rules. But even this does not stop some REITs from getting into financial trouble, as we shall see in the next section.

Is investing in REITs failsafe?

Many retail investors view REITs as a relatively low-risk investment (as compared to shares in companies) offering decent dividends. However, you should be aware that this is not always the case. The past few years have thrown out a couple of REITs getting into financial trouble. I will briefly discuss a few of them as cautionary tales. The key lesson to take from this section is that unless you are adept at reading into minute intricate financial details, you should stick to REITs with credible and reputable sponsors.

First, and probably the most notorious in this list, is Eagle Hospitality Trust (SGX: LIW), which debuted on SGX on 24 May 2019 at an issue price of US$0.78 per unit. Eagle Hospitality Trust was sponsored by Urban Commons, a real estate investment and development firm founded in 2008 and headquartered in Los Angeles. The initial property portfolio comprised 18 hotel properties in the US with an aggregate valuation of US$1.27 billion (source: SGX filing). By October 2019, Eagle Hospitality Trust was trading lower than its IPO price, at US$0.68. At the same time, KGI initiated coverage on the stock, giving it a target price of US$0.84. (source: Business Times). As an aside, I personally never trust target prices from brokerage firms. If they were so accurate and reliable, surely they would just trade accordingly and make billions arbitraging the market?

On 24 March 2020, Eagle Hospitality Trust voluntarily suspended trading in its units following difficulties repaying debt. At that point, units last traded at US$0.137, 82% lower than the IPO price. In June 2020, it was announced that the Monetary Authority of Singapore and the Commercial Affairs Department were conducting a joint investigation into directors and officials of Eagle Hospitality Trust (source: Business Times), resulting in the arrest of six former and current Singapore-based directors later that year (source: Business Times).

In January 2021, entities of Eagle Hospitality Trust filed for bankruptcy protection in the US (source: Business Times), kick-starting the process of selling the hotels to pay down debt. In July 2021, the trustee of Eagle Hospitality Trust, DBS Trustee, informed unitholders that they are unlikely to see any returns (source: Business Times). In other words, they entire investment in Eagle Hospitality Trust is likely to be worthless.

So, what happened here? While I have not delved deep into the Eagle Hospitality Trust debacle, I gather that the issue, at its core, is that of master lease agreements. Eagle Hospitality Trust’s 18 properties were leased to entities under Urban Commons (also EHT’s sponsor) under such agreements, which meant that Urban Commons was the sole renter of all 18 properties (source: Straits Times). When these master lessees defaulted on the agreements, Eagle Hospitality Trust was left with no income, and the valuations of the properties simultaneously fell because the earlier valuations were based on the rent as per the master lease agreements.

It would have been beyond the average retail investor (myself included) to tease out such intricacies from the IPO prospectus. I had not myself heard of master lease agreements before this fiasco. In terms of lessons, what I can think of are:

- Look for REITs with a reputable sponsor; and

- Look for REITs with a diversified tenant base and stay away from master lease agreements.

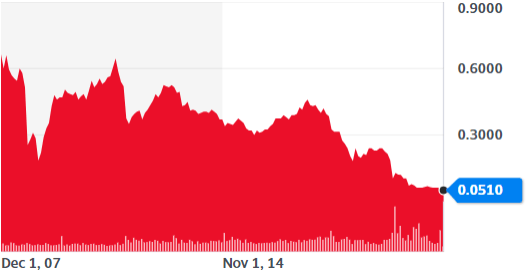

Another REIT with master lease agreements is First REIT (SGX: AW9U), which owns 20 healthcare-related assets, mainly hospitals in Indonesia. I will not go into the details of this story, but will simply point out that First REIT’s unit price has fallen from $1.41 in January 2018 to $0.255 as of 21 September 2021. You can read more about First REIT and Eagle Hospitality Trust in this short article by OCBC Research on non-traditional REIT structures. First REIT’s sister REIT, Lippo Malls Indonesia Retail Trust (SGX: D5IU), is also mentioned in the report. Its units price has been pretty much on a downward spiral since listing, as shown in Figure 5 below.

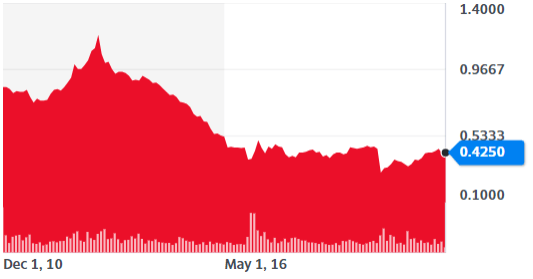

Sabana Shari’ah Compliant REIT (SGX: M1GU), listed on SGX on 26 November 2010, has seen its annual dividends fall steadily since then from 9.28 cents in FY2012 to just 2.92 cents in FY2019 before the pandemic even hit (source: Sabana REIT’s website). The share price has correspondingly fallen steadily over the past decade, as shown in Figure 6 below.

Do note that Sabana Shari’ah Compliant REIT is currently trading at a dividend yield of 8.77%. Clearly, a high dividend yield (trailing twelve months) is, in isolation, not a good indicator of a REIT as an investment. Another case in point: Dasin Retail Trust (SGX: CEDU) is currently trading at dividend yield of 12.05%, but this number is inflated by the precipitous fall in unit price in recent months, due in part to uncertainties about whether Dasin Retail Trust’s current assets are sufficient to meet short-term liabilities (source: SGX filing).

Some REITs to consider

Having seen the cautionary tales of some REITs that I would stay as far away from as possible, the natural question is, which REITs should we invest in? To me, at least, the answer is relatively clear. I will only invest in REITs backed by reputable sponsors with a good track record of managing REITs. Four such sponsors come to mind: CapitaLand, Mapletree Investments, Frasers Property, and Keppel. You will probably have heard of them before. As shown in Table 1 below, each of them sponsors multiple REITs across various types of real estate, and there are 15 REITs between them.

Being backed by a reputable sponsor with a good track record significantly reduces the risk of something major going wrong resulting in a sharp loss of investment capital, although smaller losses can still occur if you buy REIT units at an inflated price.

I have previously invested in two REITs: Mapletree Logistics Trust (SGX: M44U) and Cromwell European REIT (SGX: CWCU). I made quite a decent gain on the former but sold the latter too early, resulting in a capital loss (but overall gain with dividends included). You can view all my past transactions in the local stock market here.

Some of the REITs in Table 1 above have given investors generous capital returns, including Mapletree Logistics Trust (SGX: M44U), Mapletree Industrial Trust (SGX: ME8U), and Keppel DC REIT (SGX: AJBU). However, the flipside of high unit prices are low dividend yields, which is why I am not very interested in these three REITs at the moment.

A few months ago, a friend of mind asked me for REIT recommendations, and I mentioned Ascendas REIT, which has 211 properties across business spaces, logistics and distribution centres, industrial properties and data centres worth over S$15 billion. Dividends and unit price have been rising slowly but surely over the past decade. Combined with management by one of the strongest property firms in the region (CapitaLand), I would say that Ascendas REIT makes of a reasonably low-risk yet fruitful investment, if entered at a good price.

Having witnessed the resilience of major sub-urban malls in Singapore during the pandemic, I am currently looking at Frasers Centrepoint Trust (SGX: J69U). The numbers look good so far, and I may write a separate post analysing it in detail soon.

To sum up

- REITs are listed companies that own real estate and distribute dividends.

- Because REITs collect rent from tenants of their properties, REITs tend to distribute high, stable dividends to unitholders.

- It is not true that you cannot lose money in REITs. It is crucial that the REIT is backed by a reputable sponsor such as CapitaLand, Mapletree Investments, Frasers Property, or Keppel.

- Look for REITs that grow dividends over the years and do not require frequent cash calls. Focusing solely on dividend yield is a recipe for disaster.

Don’t want to miss out on any articles? SUBSCRIBE with your email address here: